Cadiz

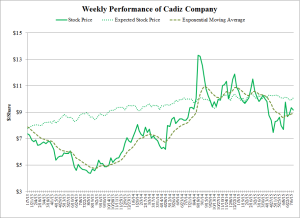

Cadiz (CDZI) stock price has turned around in the past month but still stands 9.0% below its expected price. The decline followed a report stating that the Cadiz Project has failed federal environmental review and Metropolitan Water District of Southern California not seeing how the project could be built. The price is 1.9% below the price 52 weeks ago. Reflecting the price turnaround, the price is now above the 10-week exponential moving average.

Cadiz (CDZI) price leaped earlier with issuance of a ruling dismissing all challenges to the project based on the alleged inadequacy of environmental review. The price had started declining in March when Business Week published a one-sided article about opposition to Cadiz’s Project.

CDZI stock had been underperforming relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 6.1% from January 2006 through December 2012. The Company announced a comprehensive refinancing package in March 2013 to accommodate project financing for the Cadiz Valley Water Conservation, Storage and Recovery Project. The project faces litigation challenges, although the Company has been successful in securing dismissals or settlements in mid to late 2013. The company also secured further working capital from an agreement with a senior lender in October 2013. The turnaround in the company’s stock in the latter half of 2013 has closed the gap of stock performance relative to expected prices (projected by the Capital Asset Pricing Model adjusted by historical under performance).

Pico Holdings

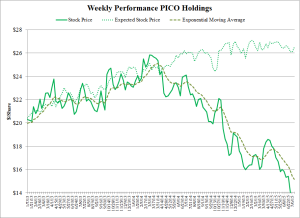

PICO Holdings (PICO) stock price decline continues. The price now stands at 47.4% below its expected price. The company is suffering losses in its three major business segments: water resources and storage, agribusiness and real estate. PICO’s price has declined by 37.9% over the past 52 weeks. The recent price turnaround, which proved temporary, may have been prompted by the announcement is that the firm has retained an investment banker to monetize its investment in Northstar (canola operations), one of the sources of operating losses. The price is below the 10-week exponential moving average. Will the free fall in PICO’s price continue?

PICO stock had been underperforming relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 4.9% from January 2006 through December 2012. The company’s stock has performed strongly in 2013, increasing by about 19% in 2013 in comparison to a decline in expected prices forecasted by the Capital Asset Pricing Model (adjusted by historical underperformance). Favorable developments for the company include a planned IPO for the company’s residential land development and residential homebuilding subsidiary, improvement in farming operations in production of canola oil and an option agreement to sell 7,240 AF of water rights in Lincoln County, Nevada to a power generation project at $12,000/AF.

You must be logged in to post a comment.