In November 2012, the San Diego County Water Authority (“SDCWA”) approved a 30-year agreement with Poseidon Resources to buy up to 56,000 acre feet (“AF”) per year of desalinated seawater produced from the Carlsbad Desalination Plant. With an annual price tag of water set at $2,041/AF to $2.295/AF (later reduced to $1,917/AF to $2,165/AF when SDCWA secured project financing at unexpectedly favorable terms), there was inevitable buzz about the project. How was the transaction structured? What does the deal say about the value of water? As with any water venture, the project also has critics about the cost of water, skeptics about risk allocation and cynics about the role of a private party. Let’s start with the facts about the transaction before discussing the issues.

Key Responsibilities of Poseidon

- Permit, design and build the desalination plant

- Permit, design and build a 10 mile 54-inch diameter conveyance pipeline to connect the plant to SDCWA’s regional distribution system

- Own, operate and maintain the desalination plant

- Supply product water: 30-year take-or-pay if delivered contract for water, minimum purchase of 48,000 AF with an option up to 56,000 AF with SDCWA

Key Responsibilities of SDCWA

- Take-or-pay for product water with minimum commitment of 48,000 AF/year

- Relining of 5.5 mile reach of aqueduct pipeline

- Water treatment plant improvements to accommodate desalinated water flows

- Receive product water

- Own, operate and maintain the Product Water Pipeline and water treatment plant

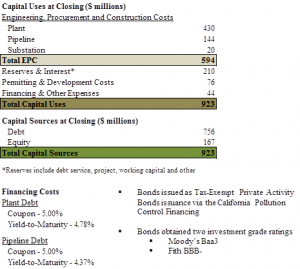

Capital Uses and Sources of Funds

In other words, the desalination plant’s engineering, construction and procurement (“ECP”) costs, $430 million, represented about 72% of total ECP costs. Total EPC costs of $594 million represent about 64% of total capital uses. Reserves and interest, permitting & development costs and financing & other expenses totaled $330 million or 36% of total capital uses. There is a lot more for an infrastructure project than ECP costs.

A desalination project with a credit worthy buyer like SDCWA was financed 82% debt and 18% private equity. The Plant Debt issued as Tax-Exempt Private Activity Bonds has a coupon rate of 5.00% and a yield-to-maturity of 4.78% (this lower yield reflected the unanticipated favorable reception of the capital market to the project). Pipeline Debt also had a coupon rate of 5.00% and an even lower yield-to-maturity of 4.37%.

Key Terms of Water Purchase Agreement

(Editors Note: information source is SDCWA staff memorandum dated November 21, 2012. This is required reading for anyone interested in the “ins” and “outs” of desalination projects.)

Term of Agreement: 30 years once commercial operations begin, subject to buyout provisions. The term can be extended by up to 3 years for force majeure events.

Buyout Provision: SDCWA may purchase the plant beginning 10 years after commercial operation at a price equal to outstanding debt plus present value of remaining equity returns and other remaining contractor costs and breakage costs. In the event of a Poseidon default, the price would only be outstanding debt.

Acquisition after 30-Year Term: SDCWA may purchase the plant for $1.

Events of Poseidon Default:

- Failure to pass acceptance testing by agreed upon Commercial Operations Date

- Poseidon bankruptcy or abandonment of the project

- Repeated violations of primary drinking water quality standards

- Multiple notices of violation or special orders issued by a regulatory agency

- Deliveries of less than 75% of the contract year amounts over a 3-year rolling period

- Failure to make Contracted Shortfall Payments for the conveyance pipeline debt service

Events of SDCWA Default: failure to pay the undisputed amount owed Poseidon within 45 days of the due date for payment.

Water Unit Price: The table below gives the estimate for 5.60% bond rate (the rate in the staff memorandum closest to the lower rates secured from the capital market). Fixed costs account for 67% of the All-in Cost of Water for an annual water delivery of 48,000 AF and 65% for an annual water delivery of 56,000 AF. Energy costs account for 19.3% of the All-in Cost of Water for an annual water delivery of 48,000 AF and for 21.7% of the All-in Cost of Water for an annual water delivery of 56,000 AF.

| Unit Price Component | Water | Delivery |

| 48,000 AF | 56,000 AF | |

|

Fixed Charges |

||

| Debt Service | $551 | $472 |

| Equity Return | $280 | $240 |

| Pipeline Installment | $238 | $204 |

| Fixed Operating Charge | $400 | $343 |

| Fixed Electricity Charge | $73 | $63 |

| Sub-Total | $1,542 | $1,322 |

|

Variable Charges |

||

| Operating | $101 | $101 |

| Electricity | $442 | $442 |

| Poseidon Management Fee | $10 | $10 |

| Sub-Total | $553 | $553 |

|

Water Unit Price |

$2,095 | $1,875 |

| Other SDCWA Costs | $193 | $165 |

|

All-in Cost of Water |

$2,288 | $2,040 |

The Equity Return is $13,440,000 under either scenario. This represents a 8% return on the $167 million of equity capital invested in the project.

The Water Purchase Agreement provides for adjustment in the various price components (see table). Concerning fixed charges related to financing, the agreement structures payments to increase at an annual rate of 2.5% (see below). The remaining price components are linked to either the San Diego Consumer Price Index or San Diego Gas & Electric rates. Under the transaction structure, about two-thirds of the Unit Water Price (related to project financing) is fixed to grow at 2.5% annually. The remaining one-third of the Unit Water Price adjusts by either the San Diego CPI or San Diego Gas & Electric rates. Under staff modeling assumptions, the later components of the Unit Water price is projected to grow at less than 2.5% (variable energy at only 2%).

|

Unit Price Component |

Contractual Provision |

Staff Modeling Assumption |

| Fixed Charges | ||

| Debt Service | 2.5% escalation (see below) | 2.5% |

| Equity Return | 2.5% escalation (see below) | 2.5% |

| Pipeline Installment Payments | 2.5% escalation (see below) | 2.5% |

| Fixed Operating Charge | Indexed to San Diego CPI | 2.5% |

| Fixed Electricity Charge | Linked to SDG&E rates | 2.0% |

| Variable Charges | ||

| Operating | Indexed to San Diego CPI | 2.5% |

| Electricity | Linked to SDG&E rates | 2.0% |

| Poseidon Management Fee | Indexed to San Diego CPI |

2.5% |

The structuring of the financing components to increase at 2.5% per year makes economic sense. Assuming an inflation rate of 2.5% (http://hydrowonk.com/blog/2013/01/11/project-evaluation-ii-thoughts-about-interest-rates/) this means that the inflation-adjusted (“real value”) of the finance component remains constant over the term of the agreement. In contrast, a standard “level” payment means that the inflation-adjusted finance payment will be the highest in the first year, steadily declining over time to less than half the amount by the end of a 30 year term. With the 2.5% annual increase in equity return, the return on equity investment is 8% + 2.5%.

Factors Making the Deal

We summarize the key points from a post on Hydrowonk Blog in January 2013 (http://hydrowonk.com/blog/2013/01/07/an-economists-perspective-on-san-diegos-desalination-project/): supply reliability, independence and controllable counter-party risk.

Supply Reliability

Seawater desalination is judged “drought proof”; plant operations are not subject to any inadequacies in the availability of water. Supply reliability is a technical question about plant construction and operating risks without hydrologic risk. Judging from public materials, San Diego found comfort in three factors:

- the technology

- the firms responsible for construction and operation

- contract structure

- San Diego only pays after the plant is constructed and operating standards met

- San Diego has contractual right to takeover the plant if performance standards are not later met

Regarding the later point, recall that Poseidon forfeits its remaining equity return in the event of default. By structuring the finance components to be increasing, the real economic value of the annual equity return cannot be eroded by inflation (see discussion above of financial component).

Independence

San Diego’s disputes with the Metropolitan Water District of Southern California are legendary. Not a drop of desalinated water will hit Metropolitan’s infrastructure. So, desalinated water is not subject to:

- any delivery interruptions under Metropolitan’s wheeling policy, and

- does not incur Metropolitan’s wheeling charges (the subject of controversy and litigation)

Delivery reliability buttresses supply reliability at the plant.

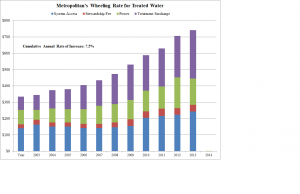

The avoided wheeling charges are material. Metropolitan’s wheeling rate for treated water tops $700/AF in 2013 and slated to reach almost $750/AF in 2014 (see chart)—wheeling of treated water is used as a benchmark for an alternative source to desalinated water. The wheeling rate has grown at a cumulative annual growth rate of 7.5% since Metropolitan’s rate restructuring in 2003. With inflation running less than 2.5% during this period, Metropolitan’s wheeling rate is increasing at more than three times the rate of inflation.

Combining operational reliability with avoided wheeling costs, desalinated water offers San Diego demonstrable benefits from independence.

Controlled Counter Party Risks

Counter party risks don’t dominate topics at water conferences. Over the years, we have come to appreciate the importance of who are your counter parties and partners. For San Diego, the promise of supply reliability and independence is a bet on plant performance and delivery performance.

Plant Performance. Poseidon Resources has raised significant private capital based on its long-term agreement with San Diego. Since San Diego “pays for performance”, the private capital transaction is based on the company earning returns from the contract. Senior management is accountable to boards that are representing, directly or indirectly, capital sources. As they say in Connecticut, “nothing like being responsible for hundreds of millions in investments to concentrate one’s mind.” Rather than a detriment, the “singular focus” of the private sector on earning returns is beneficial.

Delivery Performance. San Diego entered into ancillary agreements with local agencies to move desalinated water from the plant to a regional distribution system. These agreements are within the San Diego family. Reliance on family members may be more comfortable than reliance on outsiders.

Final Thoughts

At the turn of the 21st century, seawater desalination looked like a water supply “on the long horizon.” Congress passed the Central Valley Improvement Act in 1992 to address environmental issues and set a framework for anticipated water conservation and transfers from agricultural to municipal uses. Well, that did not work out as planned. Similarly, the State Water Project underwent amendments that include transfers of SWP Table A from agricultural to municipal water users. While there have been some transactions, the recent low SWP allocations has turned the SWP to an unreliable water source. While there was a flurry of deal activity on the Colorado River among Metropolitan Water District, Imperial Irrigation District, Palo Verde Irrigation District, San Diego County Water Authority and the Coachella Valley Water District, simmering political and environmental issues make further deals look increasingly less likely.

What is left for California? Well, there is always water conservation. What else? Water reclamation and desalination. How the early part of the 21st century looks so different from the last decade of the 20th century.

So, do you believe that San Diego County Water Authority’s seawater desalination project was a prudent investment for rate-payers? Express your opinion on Stratecon Water Policy Marketplace.

Written by Rodney T. Smith, Ph.D.

You must be logged in to post a comment.