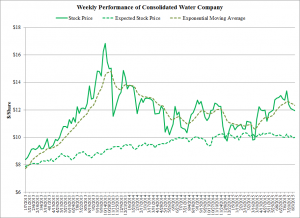

Consolidated Water Company (CWCO) stock price is now 19.4% above its expected price, reflecting a recent price decline after the company announced 2nd quarter earnings material below 2014. The stock had been on an upward trend thanks to the bump in its stock price in mid-March following an SEC 8k filing stating that it has found an equity partner for a 100,000-AF desalination plant at Rosarito Beach. It also stated that it anticipates entering into a definitive agreement with the State of Baja by February 2016. Consolidated Water’s price now stands 1.2% above its level 52 weeks ago. The stock price is running 3% below its 10-week exponential moving average.

CWCO stock had been under-performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 4.1% from January 2006 through December 2012. The company’s stock performed strongly through fall 2013 due to a run of three quarters where earnings significantly outpaced market expectations. The stock peaked in mid-October 2013 when 3rd quarter earnings fell significantly and has been on a declining trend. The company entered into a Memorandum of Understanding in November 2012 with the Otay Water District to sell at least 20 million gallons per day and up to 40 million gallons per day from a proposed seawater reverse osmosis desalination plant with a capacity of 100 million gallons per day located in northern Baja.

You must be logged in to post a comment.