| Read Historical Background |

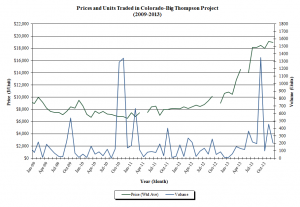

Average prices of CBT units have been trending upward over the last five years, but ran up in 2013 from about $10,000/unit early in the year to around $19,000/unit in the last quarter when average prices ranged from $17,900/unit to $19,131/unit. Sellers are now asking for prices as high $22,000/unit—but no one has reported closing a deal at that level.

Volume fluctuated dramatically over the 5-year period, but spikes in trading were generally driven by unusual deals (e.g. are large volume of CBT units are transferred as part of a larger exchange of assets) or administrative transfers (usually when units transferred to a related entity). With the unusual deals and administrative transfers excluded, there was still significant variation—with quarterly volumes seeing more than sevenfold increase from the lowest volume to the highest, annual volumes nearly doubling from the lowest volume to the highest.

2013 had the second highest volume of the 5-year period, with 3,373 units trading, including a 1,200-unit administrative transfer in the 3rd quarter (with that transfer excluded 2013 becomes the second lowest year in the period). The 4th quarter of 2013 saw a transfer of 764 units.

Each unit represents 1/310,000 of the projects supply—but the quantity of water represented by the unit varies each year according the annual quota set by the Northern Water board of directors. The annual quota has a historic average of 74% (0.74 AF/unit). For 2013, the annual quota was 60%, and the 2014 initial quota is 50%.

While the usual suspects, such as drought conditions, may be playing a role in the price run-up, local water brokers see a pick-up in development and a shift in the demographics of who owns CBT units as the primary drivers. When the CBT project began operating in 1957, 85% of the units were owned agricultural water users. Now agricultural users own only about 1/3 of the units. In addition, there are now fewer and larger agricultural operations—so the supply is limited to stronger hands that generally do not sell, except for estate settlements and retirement.

If the local water brokers are right, then expect to see the market tighten and prices continue to rise.

Written by Marta Weismann

You must be logged in to post a comment.