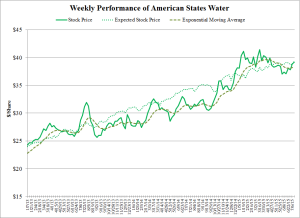

American States Water

American States Water (AWR) stock price reached its expected price. AWR’s price has increased by 27.6% over the past 52 weeks—the fastest increase among water utilities. The stock enjoyed a brief period of an over-performing stock in early March 2014 when Zack’s issued a “strong buy” opinion on the company. The stock has been in a steadily rising trend, with its current price slightly above its ten-week exponential moving average.

AWR stock had been over-performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 8.2% from January 2006 through December 2012. The company’s stock has performed strongly in 2013. The company’s unregulated subsidiary, America States Utilities Services is rapidly expanding.

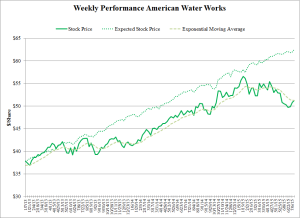

American Water Works

American Water Works (AWK) stock price is continuing its decline in 2015. It is now 18.1% below its expected price. The lagging price performance started in 2013 with announced decline in revenue from above average rainfall and cooler temperatures in its service areas in 2013. Since then, the price has increased in tandem with its expected price, although at a lower level. AWK’s price has increased by 5.5% over the past 52 weeks. A public filing by BlackRock who now owns 10% of AWK bumped the price temporarily in January 2015.

AWK stock had been over performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 12.3% from January 2006 through December 2012. AWK’s stock price generally followed the expected price forecasted by the Capital Asset Pricing Model (adjusted for historical over performance) until late August 2013.

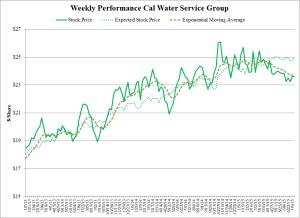

Cal Water Services

California Water Services (CWT) stock price now stands 5.5% below its expected price. CWT’s price has increased by 4.1% over the past 52 weeks. The price stands below its 10-week exponential moving average. The stock price has been on a declining trend in 2015.

CWT stock has been over performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 2.4% from January 2006 through December 2012. Cal Water’s stock price generally followed the expected price forecasted by the Capital Asset Pricing Model (adjusted for historical over performance) in 2013 until mid-October. The increased pricing followed the announcement of a settlement of the company’s general rate case with the California Public Utilities Commission Office of Ratepayer Advocates.

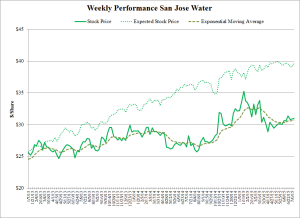

San Jose Water

San Jose Water (SJW) stock price is 22.1% below its expected price—a significant deterioration since March. The recent price jump is in response to a long awaited California PUC decision on the company’s 2013 rate case. SJW’s price has increased by 16.1% over the past 52 weeks.

SJW stock has been over performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 2.8% from January 2006 through December 2012. San Jose’s stock price performance has generally lagged behind the price forecasted by the Capital Asset Pricing Model (adjusted by historical over performance) for most of 2013 until last December. The company announced the appointment of a New Chief Administrative officer on January 30, 2014.

You must be logged in to post a comment.