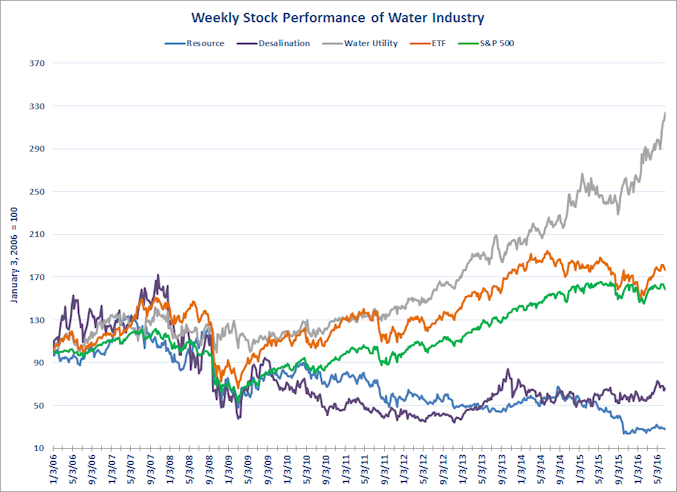

The water industry is becoming increasingly followed by the investment community. There are four major Exchange Traded Funds listed today that enable investors to invest in the water industry in the United States and overseas. A few water resource development firms are traded publicly. One seawater desalination firm is traded in the United States. A handful of regulated water utilities are publicly held. Capital markets may not be clairvoyant, but they can be informative about the consequences of trends and events in the industry.

Capital Markets provides information and analysis on developments concerning water exchange traded funds, water development firms and water utilities. We create performance charts and indexes for industry segments, as well as provide occasional commentary.

JOW tracks firms in three areas of the water industry:

- Resource Development Firms: Cadiz Inc. (CDZI) and PICO Holdings (PICO)

- Desalination Firm: Consolidated Water Company (CWCO)

- Water Utilities: American States Water (AWR), American Water Works Company (AWK), California Water Service Group (CWT),

and San Jose Water Company (SJW) - Exchanged Traded Funds (ETF): PowerShares Water Resources (PHO), First Trust ISE Water Idx (FIW), Guggenheim S&P Global Water Index (CGW),

and PowerShares Global Water (PIO).

Occasional Capital Market Commentary: Water Utilities and California’s Drought June 2015

| Occasional Capital Market Commentary Archive |