A market has developed among members of the Appropriative Pool in the Chino Basin in Southern California. The Chino Basin has a long history beginning with the execution of a Memorandum of Agreement in 1974, a judgement adjudicating the basin in 1978, the development of the Optimum Basin Management Program in 1998, execution of the Peace Agreement in 2000—which established the parties’ intent to implement the Optimum Basin Management Program, and execution of another agreement, known as Peace II—which provided for reoperation of the basin.

The judgement established an initial operating safe yield of 145,000 acre-feet annually, and divided it among three classes of users:

- The Agricultural Pool was allocated 82,800 AF per year.

- The Non-Agricultural Pool, which is composed of commercial and industrial water users, was allocated 7,366 AF per year.

- The Appropriative Pool, which represents cities, water districts and water companies, was allocated 54,834 AF per year.

Water market activity generally occurs in the form of annual leases among members of the Appropriative Pool. The watermaster records two additional types of transfers: 1) transfers that are recorded as the manner of utilizing water company shares and 2) exchanges for water from another basin. These transfers are excluded from JOW’s analysis because they are administrative—not water market—transactions.

Parties enter into leases to meet water supply needs or to offset overproduction. When water is transferred to offset overproduction, a portion of the cost may be subsidized under what is known as the “85/15 Rule.” However, the buyer must be an 85/15 party, and the water must be acquired to offset overproduction. If those conditions are met, then 15% of the lease price is paid by the 85/15 parties collectively. Most of the Appropriators are 85/15 parties; the small number that are not, either opted out or intervened in the judgement later (so they were not original parties to the adjudication).

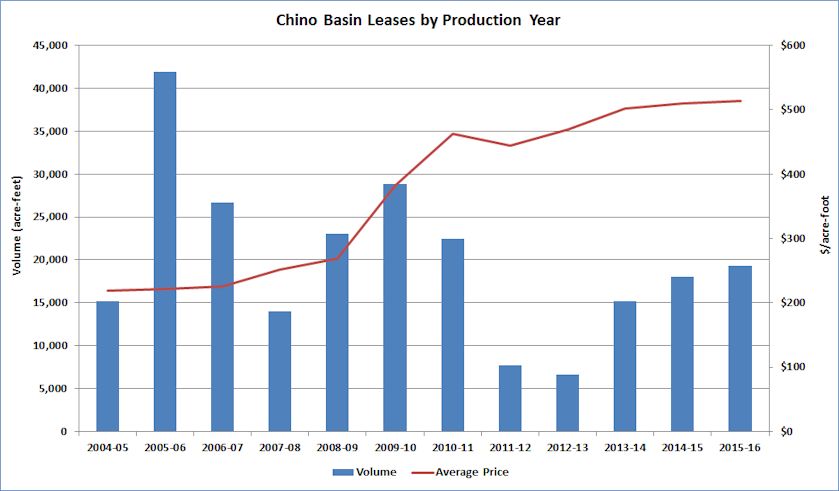

The volume leased among Appropriators continued to increase from the low of 6,606.50 AF in FY 2012-13. A total of 19,305.50 AF traded in FY 2015-16—up from 18,074.50 AF and 15,221.50 AF in the previous two years.

The average price increased 0.9% to $514.20/AF from $509.63/af. Over the previous 10 years, the average annual change was an increase of 10.4% (with a median annual increase of 6.9%).

Leasing activity correlates with hydrologic conditions. The years with the three lowest volumes (FY 2007-08, FY 2011-12 and FY 2012-13) were also drought years. Conversely, the years with the two highest volumes (FY 2005-06 and FY 2009-10) were also wetter than normal. 2006 was the last time that the State Water Project provided 100% allocations, and FY 2009-10 saw increased rainfall after the 2007-2009 drought. Recent storms in the region are offering hope for a wetter-than-normal year this year.

In addition, the Chino Basin Watermaster recently submitted to the court a Safe Yield Reset Agreement that would reset the safe yield to 135,000 AFY effective July 1, 2010. There will be no retroactive accounting, despite the retroactive effective date. Other major terms of the agreement would specify a reset schedule every 10 years beginning in 2020, establish a safe storage reserve of 130,000 AF to protect against a precipitous drop in water levels, and govern the accounting of desalter-induced and stormwater recharge. If the new safe yield leads to a reduction in allocations, water market activity could pick up as Appropriators seek to meet water supply needs and offset over-pumping. Meanwhile, expect existing patterns to continue.

Written by Marta L. Weismann

You must be logged in to post a comment.