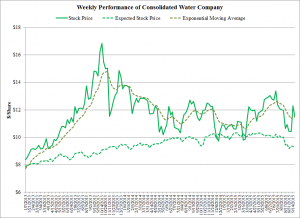

Consolidated Water Company (CWCO) stock price is now 24.1% above its expected price, reflecting price increases in the past month. The price jump followed a public story regarding a successful demonstration by BioLargo validating the company’s technical claims that their AOS filter costs 1/20th the nearest technical competitor, with greater than 100 times the efficacy (disinfection) and greater than 10 times faster than any technical competitor. Consolidated was identified in a wire story as a potential beneficiary from adoption of the AOS filter in its desalination projects.

The stock had been on an upward trend thanks to the bump in its stock price in mid-March following an SEC 8k filing stating that it has found an equity partner for a 100,000-AF desalination plant at Rosarito Beach. It also stated that it anticipates entering into a definitive agreement with the State of Baja by February 2016. However, Consolidated Water’s price now stands only 0.1% above its level 52 weeks ago. The stock price is running at its 10-week exponential moving average.

CWCO stock had been under-performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 4.1% from January 2006 through December 2012. The company’s stock performed strongly through fall 2013 due to a run of three quarters where earnings significantly outpaced market expectations. The stock peaked in mid-October 2013 when 3rd quarter earnings fell significantly and has been on a declining trend. The company entered into a Memorandum of Understanding in November 2012 with the Otay Water District to sell at least 20 million gallons per day and up to 40 million gallons per day from a proposed seawater reverse osmosis desalination plant with a capacity of 100 million gallons per day located in northern Baja.

You must be logged in to post a comment.