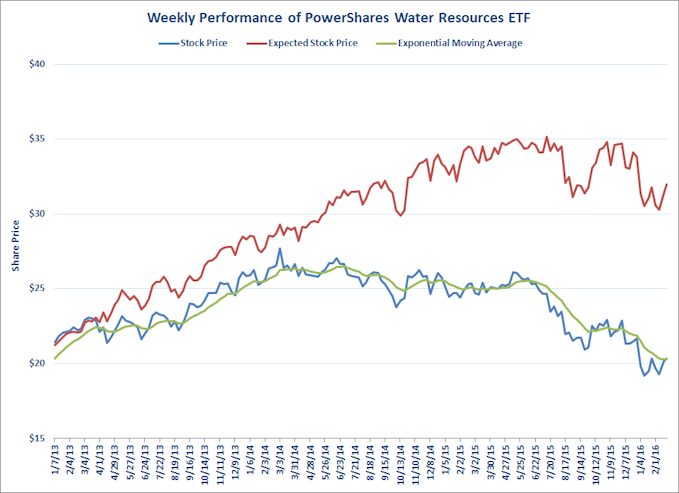

Powershares Water Resources

Powershares Water Resources (PHO) stock still stands at 36.4below its expected price. Powershares price has decreased by 17.4% over the past 52 weeks. The stock price peaked in March 2014 and has been on a steady decline ever since.

PHO stock had been over performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 2.9% from January 2006 through December 2012. Powershares price has generally followed the expected price forecasted by the Capital Asset Pricing Model adjusted by the historical over performance through the first quarter of 2013. Thereafter, its performance has lagged behind its expected price.

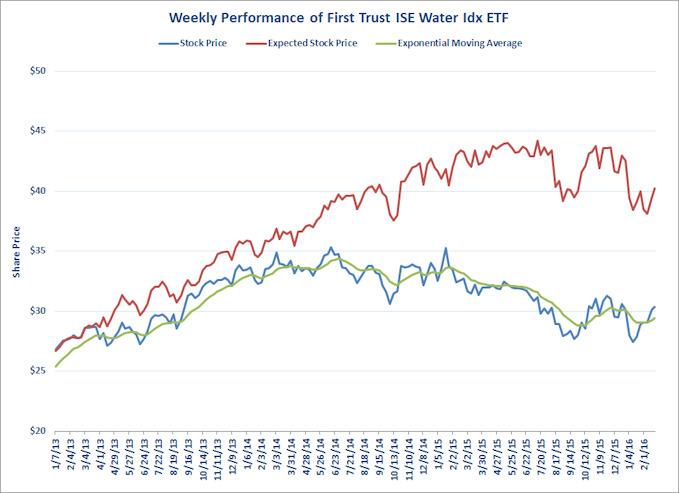

First Trust ISE Water

First Trust ISE Water (FIW) stock now stands at 24.6% below its expected price. First Trust’s price is down 3.5% over the past 52 weeks when the stock price peaked.

FIW stock has been over-performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 6.4% from January 2006 through December 2012 and is the strongest performer of the four water ETF’s tracked by JOW. Despite this historical performance, First Trust’s actual price started falling behind the expected price forecasted by the Capital Asset Pricing Model (adjusted by the historical over performance) by the end of the first quarter 2013.

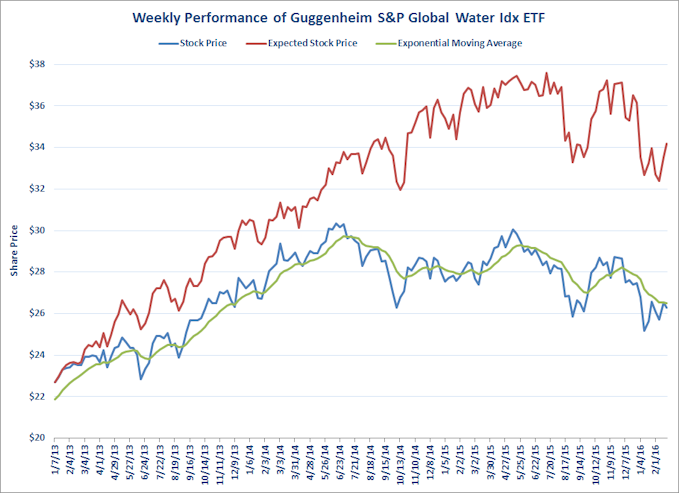

Guggenheim S&P Global Water

Guggenheim S&P Global Water (CGW) stock is 23.2% below its expected price. Guggenheim’s price is down 4.1% over the past 52 weeks when the stock price peaked.

CGW stock has been over-performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 1.6% from January 2006 through December 2012. Guggenheim’s actual price started falling behind the expected price forecasted by the Capital Asset Pricing Model (adjusted by the historical over performance) by the end of the first quarter 2013.

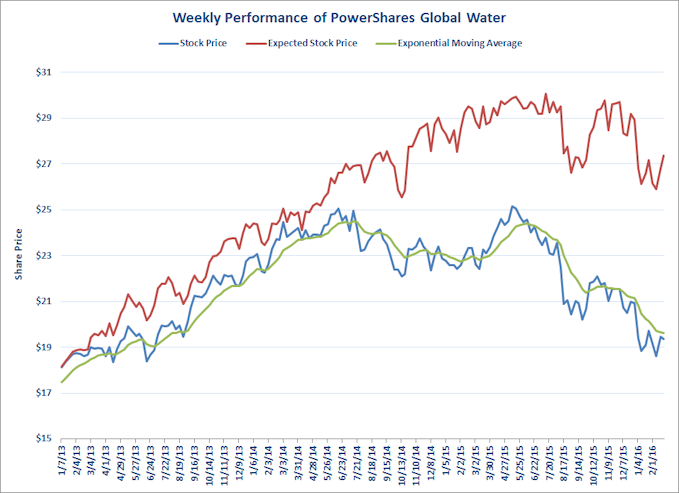

Powershares Global Water

Powershares Global Water (PIO) stock price now stands at 29.2% below its expected price. Powershares Global’s price is down 13.6% over the past 52 weeks when the stock price peaked.

PIO stock had been under-performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 2.1% from January 2006 through December 2012. The actual price has generally followed the expected price forecasted by the Capital Asset Pricing Model (adjusted by this historical under-performance) over 2013. The actual stock price started running ahead of the expected price since last December.

You must be logged in to post a comment.