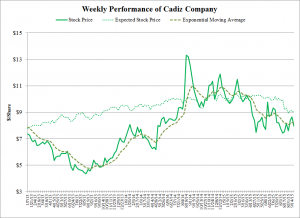

Cadiz

Cadiz (CDZI) stock price has increased over the past month but still stands 11.5% below its expected price. The recent price increase may be driven by the announcement of a joint venture with a technology firm to treat Chromium 6 (see “Cadiz Water Project Meets Critical Milestone with Innovative CR-6 Treatment Technology” in this issue). This price increase comes on the heels of a significant price decline last Spring following a report stating that the Cadiz Project has failed federal environmental review and Metropolitan Water District of Southern California not seeing how the project could be built.

The price now stands 19.3% below the price 52 weeks ago (when its price fluctuating above $9/share). Despite the recent price recovery, the stock price is 3% below its 10-week exponential moving average.

Cadiz (CDZI) price leaped in August 2014 with issuance of a court ruling dismissing all challenges to the project based on the alleged inadequacy of environmental review. The price had started declining in March 2014 when Business Week published a one-sided article about opposition to Cadiz’s Project.

CDZI stock had been underperforming relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 6.1% from January 2006 through December 2012. The Company announced a comprehensive refinancing package in March 2013 to accommodate project financing for the Cadiz Valley Water Conservation, Storage and Recovery Project. The project faces litigation challenges, although the Company has been successful in securing dismissals or settlements in mid to late 2013. The company also secured further working capital from an agreement with a senior lender in October 2013. The turnaround in the company’s stock in the latter half of 2013 has closed the gap of stock performance relative to expected prices (projected by the Capital Asset Pricing Model adjusted by historical under performance).

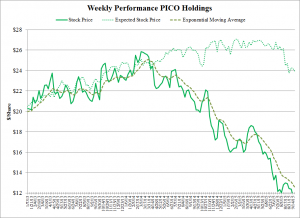

Pico Holdings

PICO Holdings (PICO) stock price remains in free fall. The price now stands at 53.4% below its expected price. The company is suffering losses in its three major business segments: water resources and storage, agribusiness and real estate. PICO’s price has declined by 44.6% over the past 52 weeks. A recent price turnaround last April, which proved temporary, may have been prompted by the announcement that the firm has retained an investment banker to monetize its investment in Northstar (canola operations), one of the sources of operating losses. The price is 11% below the 10-week exponential moving average. Will the free fall in PICO’s price continue?

PICO stock had been underperforming relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 4.9% from January 2006 through December 2012. The company’s stock has performed strongly in 2013, increasing by about 19% in 2013 in comparison to a decline in expected prices forecasted by the Capital Asset Pricing Model (adjusted by historical underperformance). Favorable developments for the company include a planned IPO for the company’s residential land development and residential homebuilding subsidiary, improvement in farming operations in production of canola oil and an option agreement to sell 7,240 AF of water rights in Lincoln County, Nevada to a power generation project at $12,000/AF.

You must be logged in to post a comment.