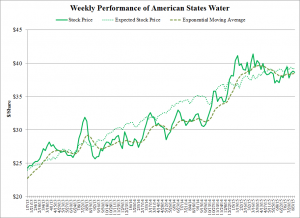

American States Water

American States Water (AWR) stock price hovers around its expected price. AWR’s price has increased by 21.7% over the past 52 weeks—the fastest increase among water utilities. The stock enjoyed a brief period of an over-performing stock in early March 2014 when Zack’s issued a “strong buy” opinion on the company. The stock price peaked last March and has since been on a declining trend. The price has been moving upward since June.

AWR stock had been over-performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 8.2% from January 2006 through December 2012. The company’s stock has performed strongly in 2013. The company’s unregulated subsidiary, American States Utilities Services is rapidly expanding.

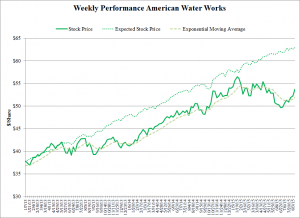

American Water Works

American Water Works (AWK) stock price may have turned in the last month. It is now 14.6% below its expected price. The lagging price performance started in 2013 with announced decline in revenue from above average rainfall and cooler temperatures in its service areas in 2013. Since then, the price has increased in tandem with its expected price, although at a lower level. AWK’s price has increased by 8.2% over the past 52 weeks. A public filing by BlackRock who now owns 10% of AWK bumped the price temporarily in January 2015. The turnaround in the price this June was driven by the acquisition of Keystone Clearwater Solutions, a freshwater pipeline producer who pumps and stores water for natural gas producers.

AWK stock had been over performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 12.3% from January 2006 through December 2012. AWK’s stock price generally followed the expected price forecasted by the Capital Asset Pricing Model (adjusted for historical over performance) until late August 2013.

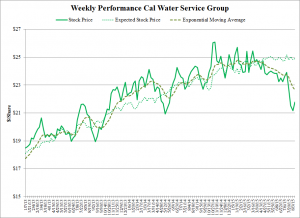

Cal Water Services

California Water Services (CWT) stock price fell sharply the past month with concerns that the mandatory water conservation due to California’s drought will reduce the company’s earnings prospects. The price now stands 12.5% below its expected price. CWT’s price has declined by 9.8% over the past 52 weeks. The price stands below its 10-week exponential moving average. The stock price has been on a declining trend since March 2015.

CWT stock has been over performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 2.4% from January 2006 through December 2012. Cal Water’s stock price generally followed the expected price forecasted by the Capital Asset Pricing Model (adjusted for historical over performance) in 2013 until mid-October. The increased pricing followed the announcement of a settlement of the company’s general rate case with the California Public Utilities Commission Office of Ratepayer Advocates.

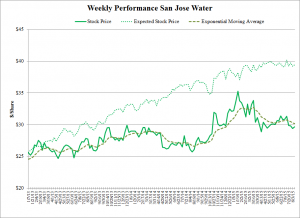

San Jose Water

San Jose Water (SJW) stock price is 24.8% below its expected price reflecting a significant price deterioration in 2015. The recent price jump is in response to a long awaited California PUC decision on the company’s 2013 rate case. SJW’s price has increased by 13.7% over the past 52 weeks.

SJW stock has been over performing relative to the returns forecasted by the Capital Asset Pricing Model by an annual rate of 2.8% from January 2006 through December 2012. San Jose’s stock price performance has generally lagged behind the price forecasted by the Capital Asset Pricing Model (adjusted by historical over performance) for most of 2013 until last December. The company announced the appointment of a new Chief Administrative Officer on January 30, 2014.

You must be logged in to post a comment.