Because the Northern Colorado Water Conservancy District (“Northern Water”) established simple mechanisms to allow trading of Colorado-Big Thompson (“CBT”) Project water, CBT units have been trading widely for about 60 years. The CBT Project is a federal water diversion project that brings water from the Colorado River headwaters on the West Slope to the Big–Thompson River, a tributary to the South Platte River, to provide a supplemental source of water to Colorado’s Front Range—supplying 960,000 people and 640,000 acres of irrigated agricultural lands in Northern Colorado.

The project facilities and water rights are owned by the U.S. Bureau of Reclamation, but Northern Water, a quasi-municipal entity and political subdivision of the State of Colorado, manages the project.

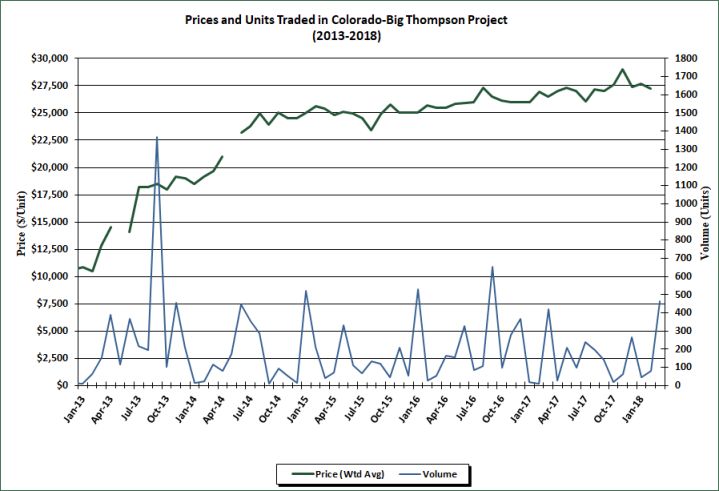

The average price for CBT units ranged from $27,274/unit to $27,692/unit in the first quarter of 2018. Prices for individual transactions generally ranged from $27,200/unit to $28,500/unit, which one exception: a transfer of 175 units from a dairy farm to the Town of Milliken went for $27,000/unit. While this transfer was not significantly below market, having an extraordinarily large transaction close at the lowest price of the quarter, does measurably impact the average price. If this transaction is excluded from the analysis, the average prices ranged from $27,405/unit to $28,317/unit. In the fourth quarter of 2017, prices ranged from $27,000/unit to $29,011/unit. The first quarter of 2017 saw prices ranging from $26,000/unit to $26,928/unit.

During the first quarter of 2018, at total of 589 units changed hands (including the 175 units that were acquired by the Town of Milliken). Monthly volumes ranged from 44 units to 466 units, and 60% of individual transfers (not including dedications) were 10 units or less. In the fourth quarter of 2017, a total of 347 units changed hands, with monthly volumes ranging from 17 units to 266 units. The first quarter of 2017 saw 444 units change hands, with monthly volumes ranging from 8 units to 419 units. (See chart)

The Northern Water Board of Directors approves transfers of CBT units and sets quotas to determine the yield of each unit. The project has 310,000 units. The board sets an initial quota each November and revisits it the following April. The April quota allows all CBT Project water users to plan for their water supply needs. The board began setting an initial quota in November 2001 to allow municipal and domestic water users access to CBT water in the winter months without incurring a negative balance when the quota is set in April. The board considers both the availability of water and the water needs in the region when it determines the quota. If conditions warrant, the board will announce a supplemental quota. The annual quota has a historic average of 74% (0.74 AF/unit). At its April 2018 meeting, the Northern Water Board of Directors increased the 2018 quota to 80% from the 50% initial quota it set in October 2017. Water Resources Engineer Sarah Smith noted that storage has been above average for five consecutive years, and, despite below average precipitation throughout the state this winter, recent storms boosted snowpack in northern Colorado.

CBT activity has decreased significantly since the late 1990s and early 2000s, with total annual volumes now coming in at one-third to one-half the annual volumes traded in those earlier years. According to local water brokers, development and a shift in the demographics of who owns CBT units have caused this change in market activity. Past drought conditions and uncertainty over water supplies may also be playing a role. When the CBT project began operating in 1957, 85% of the units were owned by agricultural water users. Now agricultural users own only 30% of the units. In addition, there are now fewer and larger agricultural operations—so the supply is limited to stronger hands that generally do not sell, except for estate settlements and retirement.

While there are occasional spikes in volume driven by unusually larger transactions, the overall trend continues to show volume dropping and prices climbing toward $30,000/unit.

(For more extensive background on the history of the CBT Project, see “Trading Federal Project Water: The Colorado–Big Thompson Project,” WS, October 1990).

Written by Marta L. Weismann

You must be logged in to post a comment.