A market has developed among members of the Appropriative Pool in the Chino Basin in Southern California. The Chino Basin has a long history beginning with the execution of a Memorandum of Agreement in 1974, a judgement adjudicating the basin in 1978, the development of the Optimum Basin Management Program in 1998, execution of the Peace Agreement in 2000—which established the parties’ intent to implement the Optimum Basin Management Program, and execution of another agreement, known as Peace II—which provided for reoperation of the basin.

Watermaster studies have concluded that the Safe Yield for the period 2011 through 2020 is 135,000 ac-ft, or 5,000 ac-ft lower than the Safe Yield set in the 1978 Judgment. A Safe Yield Reset Agreement was submitted to the court, and an April 28, 2017 Court Order related to the Safe Yield Reset accepted the reduced Safe Yield and rejected all other matters. An appeal has been filed related to the other matters, which relate to allocation of unproduced Agricultural Water, allocation of Desalter Replenishment Obligation, and the schedule for the authorized overdraft to offset Desalter Replenishment obligation. Under the revised Safe Yield, the overlying landowners’ rights, which total about 90,000 AF per year, remain unchanged, hence the appropriative rights, also referred to as Operating Safe Yield, are being lowered by 5,000 AF per year. The appropriative rights are allocated in the same proportion as originally set in the 1978 Judgment.

Water market activity generally occurs in the form of annual leases among members of the Appropriative Pool. The watermaster records two additional types of transfers: 1) transfers that are recorded as the manner of utilizing water company shares and 2) exchanges for water from another basin. These administrative transfers, which do not reflect water market conditions, are excluded from JOW’s analysis.

Parties enter into leases to meet water supply needs or to offset overproduction. When water is transferred to offset overproduction, a portion of the cost may be subsidized under what is known as the “85/15 Rule.” However, the buyer must be an 85/15 party, and the water must be acquired to offset overproduction. If those conditions are met, then 15% of the lease price is paid by the 85/15 parties collectively. Most of the Appropriators are 85/15 parties; the small number that are not, either opted out or intervened in the judgement later (so they were not original parties to the adjudication).

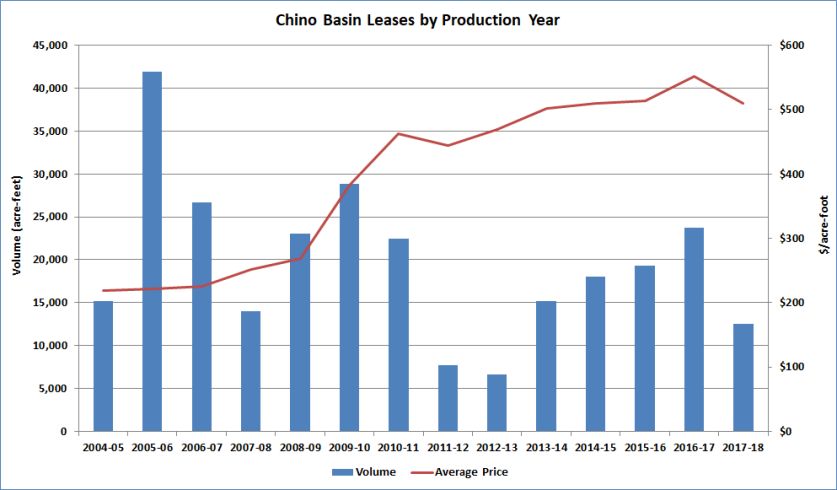

After steadily increasing over several years the volume leased among Appropriators dropped. In FY 2017-18 leases totaled 12,509 AF—compared to a total of 23,731.71 AF traded in FY 2016-17—which was up from the FY 2015-16 total of 19,305.20 AF, as well as totals of 18,074.50 AF and 15,221.50 AF in the previous two years and an all-time low of 6,606.5 AF in FY 2012-13.

The average price decreased in FY 2017-18 about 7.5% to $510.35/AF from $551.93/AF in FY 2016-17, but overall has been increasing in small increments each year from $218.37/AF in FY 2004-05.

Leasing activity correlates with hydrologic conditions. The years with the three lowest volumes (FY 2007-08, FY 2011-12 and FY 2012-13) were also drought years. Conversely, the years with the two highest volumes (FY 2005-06 and FY 2009-10) were also wetter than normal. 2006 was the last time that the State Water Project provided 100% allocations, and FY 2009-10 saw increased rainfall after the 2007-2009 drought. While FY 2016-17 appears to defy the trend, only one of the 11 transactions occurred before the wet conditions arrived. Hot and dry conditions resumed in 2018, and the leasing activity held true to the trend.

With 2019 seeing wetter conditions—with precipitation levels currently showing no drought within the state according to the U.S. Drought Monitor—expect activity to be higher.

Written by Marta L. Weismann

You must be logged in to post a comment.