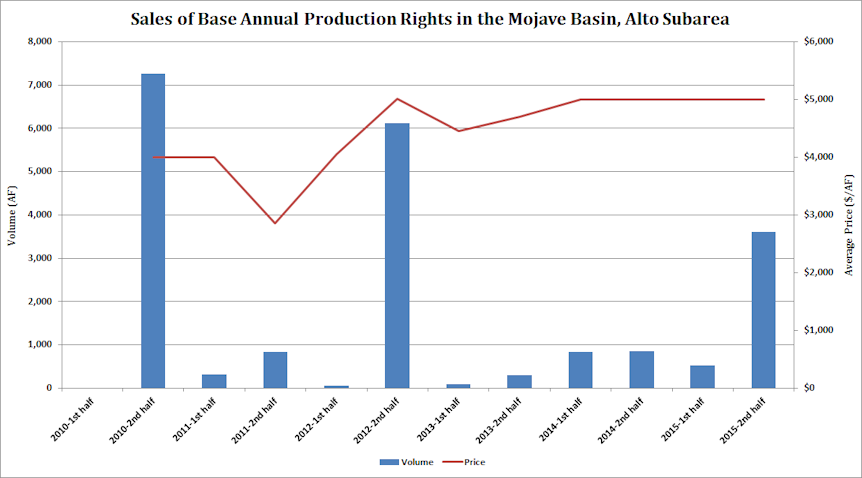

Sales of Base Annual Production Rights

Generally, the volume of Base Annual Production rights traded is small, with spikes in volume driven by the occasional large transaction. The second half of 2015 saw such a spike. In October 2015, CalPortland Company announced the purchase of the Riverside Cement Company Oro Grande Plant. The transfer of BAP under that business transaction accounted for 3,452 AF of the 3,615 AF transferred in the second half of 2015. In the first half of 2015, a total of 525 AF were traded—compared to 844 AF in the first half of 2014 and 862 AF in the second half of 2014.

After generally trending upward since the inception of the market, prices continue to sit around $5,000/AF, where they have been for the past two years.

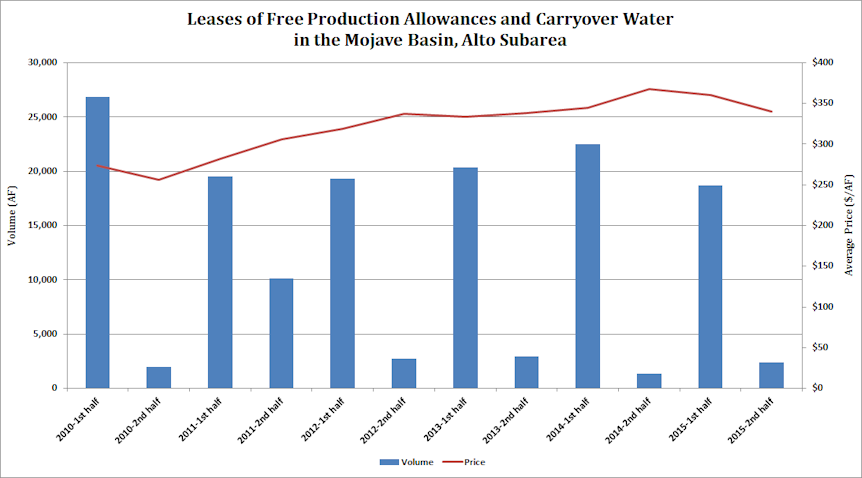

Leases of Free Production Allowances and Carryover

The volume of leases of FPA and carryover water in the Alto Subarea tends to fluctuate: high in the first half of the year and low in the second half. Because the Mojave Basin Watermaster operates on a fiscal year, the short-term transfers approved in the first half of the calendar year may reflect efforts to prepare for the new watermaster year.

Volume totaled 2,355 AF in the second half of 2015—compared to 1,332 AF in the second half of 2014 and 2,963 AF in the second half of 2013. The first half of 2015 saw 18,721 AF leased.

The average prices for leases of FPA trended upward from the beginning of the market through the second half of 2014, when they reached a peak of $368/AF. During 2015, prices eased—dropping to $360/AF in the first half of the year and to $340/AF in the second half.

With no known pressures on the market, will activity and prices remain the same?

Written by Marta L. Weismann

You must be logged in to post a comment.