In October 2014, the San Antonio Water System executed an agreement with Abengoa Vista Ridge LLC for the delivery of up 50,000 acre-feet (“AF”) per year of groundwater from Burleson, Texas starting in 2019. The project consortium is a partnership between Abengoa (a Spanish-based water infrastructure company) and BlueWater Systems (an Austin-based company that assembled 3,400 leases of water rights from landowners in Burleson and Milam Counties and production and export permits from the Post-Oak Savannah Groundwater Conservation District). Abengoa will build and operate well-field infrastructure and a 142-mile water pipeline from Burleson County to San Antonio. SAWS will build interconnection infrastructure at an estimated cost of $100 million.

The agreement runs 500+ pages and provides a detailed blueprint for how the parties will cooperate in the development and operation of the project. Abengoa will work through a newly created Water Supply Corporation, which under Texas law is a non-profit entity that will operate the pipeline. This corporation will be the conduit for tax-exempt debt financing.

The “Commercial Close” occurred with contract execution. The “Financial Close” will occur within 18 to 30 months. Construction is anticipated to take 42 months. Water deliveries are anticipated to start in 2019.

The agreement specifies 26 conditions of the Financial Close, generally related to final determination of project facilities design and location, acquisition of real property, final agreements with the Water Supply Corporation (in a form acceptable to SAWS), legal opinions and other matters including definitive Senior Debt Financing Agreements and Equity Contribution Agreement of funds sufficient to pay for the capital costs in accordance with a mutually agreeable project costs as reflected in a Financial Model.

The agreement uses the Financial Model as a tool for adjusting various financial terms of the agreement. For example, the capital cost component of the “Unit Price” of water will be adjusted for any changes in interest rates between the execution date of the agreement and the Financial Close. The Financial Model is also used to adjust pricing for major capital replacements.

Term

The term of the agreement is 30 years, unless extended up to 50 years as required for “make-up deliveries” so that cumulative deliveries are 1.5 million AF (30 x 50,000). Abengoa will assign the project’s assets to SAWS without any further compensation.

Pricing

The agreement price of delivered water is a sum of various components estimated to total $2,024/AF (see table). The Capital Charge will be adjusted for changes in interest rates from the date of the Commercial Close and the Financial Close, subject to a maximum Capital + Water Charge of $1,959/AF. After the financial close, the Capital + Water charges are fixed over the term of the agreement. Only the fixed and variable compensable costs (generally O&M, repairs, etc.) are subject to adjustment. Under the agreement, these charges are based on annual budgets approved by the parties.

Unit Price ($/AF)

| Component | Amount | Adjustments |

| Debt Charge | $1,047.76 | Fixed |

| Equity Charge | $344.60 | Fixed |

| Capital Charge | $1,392.36 | |

| Water | $460.00 | Fixed |

| Capital + Water | $1,852.36 | |

| Fixed Compensable Cost | $135.25 | change in approved budget |

| Variable Compensable Cost | $36.39 | change in approved budget |

| Sub-Total | $171.64 | |

| Grand Total | $2,024.00 |

The fixed nature of the capital charge and water price allocates inflation risk to capital sources and water right owners. The consequences of this risk allocation varies among those parties.

For debt holders, they commonly bear inflation risk. The interest rate at which they will purchase debt depends on the “real, risk free rate” (commonly measured by return on Treasury Inflation Protected Securities, or “TIPS”), the expected rate of inflation, and a default risk premium. The sale of the debt (within 30 months) will reflect inflationary expectations at that time.

The agreement calculates the equity charge so that Abengoa earns a pre-tax internal rate of return on equity investment of 13.741%. Evidently, Abengoa found this return acceptable given its inflationary expectations and satisfactory equity returns.

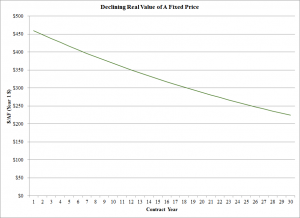

The fixed water price is a different story. The real value of the water payment will decline with inflation. Assuming that future inflation is at the long-term rate of 2.5%, the $460/AF fixed price would be worth $368/AF within 10 years, $288/AF in 20 years, $225/AF in 30 years (click on figure below).

Another way of making the point would be to determine what start price with an inflationary adjustment would be financially-equivalent to the $460/AF fixed price over 30 years (see table). The answer depends on the interest rate and expected inflation. Assuming a long-term inflation rate of 2.5% and a 10% interest rate, a start price of $361/AF with an inflationary adjustment is financially equivalent to the fixed $460/AF price in the agreement.

Inflation-Adjusted Start Price Financially Equivalent to $460/AF Fixed Price

| Interest | Inflation | ||

| Rate | 1.5% | 2.5% | 3.5% |

| 6% | $386 | $341 | $299 |

| 8% | $393 | $351 | $312 |

| 10% | $399 | $361 | $324 |

| 12% | $404 | $369 | $336 |

| 14% | $409 | $377 | $346 |

Recall that deliveries are not anticipated to start before 2019. To determine the prices stated in this year’s dollars (2015), one must take into account four years of inflation. Therefore, the water price stated in 2015 dollars would be less than stated in the above table.

SAWS Option

SAWS has an option to acquire the company’s project assets at any time after the Financial Close. SAWS payment would equal the sum of (i) prepayment of Senior Debt outstanding and related fees, (ii) the company’s cost of terminating and winding up its business, and (iii) the present value of any remaining equity charges (pre-tax). The calculation of present value would use an interest rate of 8.93165% (the pre-tax equity return of 13.741% multiplied by .65).

Default Remedies

The agreement has a long default list. For the company, the list includes failure to meet operating standards, bankruptcy and change in control. For SAWS, the major default would be untimely payment. If SAWS defaults and does not cure, the company can compel a buy-out at the amount described above. If the company defaults and does not cure, SAWS can acquire the company’s assets and pay only the first two items in the amount described above (the company loses any remaining equity charges).

Factors Making the Deal

The project achieves a longstanding SAWS objective to diversify its water supply sources off the Edwards Aquifer. As San Antonio has grown, SAWS has acquired Edwards groundwater rights from farmers mostly west of San Antonio. In accordance with the transfer rules governing these groundwater rights, SAWS moves the pumping location to San Antonio. The result is that pumping becomes more concentrated in San Antonio, which lowers well levels and exposes the San Antonio Pool to more frequent and more severe cutbacks in allowed pumping. Furthermore, increased pumping in San Antonio reduces flows at Comal Springs and San Marcos Springs, habitat for endangered species.

Final Thoughts

Many have found the $2,024/AF price “pricey.” A better way to look at this transaction is that there is substantial value for supply diversification and supply reliability. SAWS Edwards water rights (the backbone of its existing supply portfolio) are subject to frequent and severe cutbacks. The aquifer backing Vista Ridge is believed to be sustainable and reliable. Therefore, the value of supply reliability and diversification supports the $1,600/AF ($2,024/AF – $400/AF) capital and operating costs of moving the water through a 142 mile pipeline. Further, with all but $172/AF of the costs fixed in nominal terms by contract, it makes sense to pay a higher price today and avoid inflation risk.

Written by Rodney T. Smith, Ph.D.

Editor’s Note: This analysis was updated on 3/4/15 to correct a typographical error to the water price in the Unit Price table.

You must be logged in to post a comment.