Demand for Lower Rio Grande water created a lease market in south Texas. Lease prices vary by use, with agricultural water users typically paying lower rates per acre-foot because they have lower consumptive use of water.

Municipal users have priority in the system, with a municipal reserve of 225,000 AF reestablished each month. Excess water is allocated to irrigators, who must have a balance available in a revolving account to take delivery of water. The long-term average allocation for Lower Rio Grande contracts is 2.5 AF/acre.

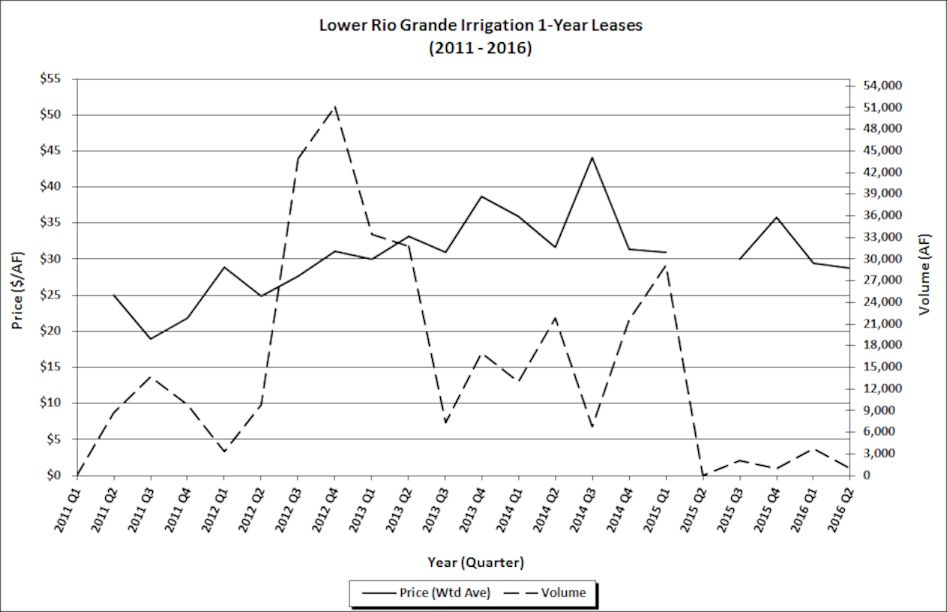

Between 2009 and early 2011, water supplies were abundant, so the watermaster was able to provide full allocations (4 AF/acre), and during flood operations at the Falcon and Amistad Dams, the Rio Grande Watermaster provided “free water” that does not count against contractors’ accounts. As a result, leasing activity for irrigation water was sparse during that time.

Heavy rain and flooding in the spring of 2015 led to a similar situation depressing leasing activity for 2015. The low level of activity has continued in 2016. During the second quarter of 2016, there were nine leases for irrigation water totaling 942.4 AF—compared to no leases in the second quarter of 2015 and 21,791 AF in the second quarter of 2014. In the first quarter of 2016, there were seven leases for irrigation water totaling 3,665 AF (with 2,500 AF accounted for by a single transfer from U.S. Fish & Wildlife to Delta Lake Irrigation District).

Prices for irrigation continue to ease. During the second quarter of 2016, prices ranged from $25/AF to $30/AF, with an average price of $28.73/AF—down from an average price of $29.42/AF in first quarter of 2016. In 2015, the average price ranged from $30/AF to $35.78/AF, with no leases in the second quarter of 2016.

Because municipal users have priority in the system, the market for leases of municipal water is usually thin. Activity for industrial use and mining is also limited. In the second quarter, there were two leases for municipal water total 120 AF at a price of $65/AF. A total of 4 AF were leased for mining use at a price of $100/AF.

When dry conditions resumed after the 2009-2011 wet period, so did leasing activity. The market peaked in the 4th quarter of 2012 with irrigation leases totaling 51,183 AF for just that quarter, and trading remained high—rivaling or exceeding the amount of activity seen during the drought of the late 1990’s.

If past behavior is the best indicator of future behavior, a similar pattern can be expected this time. However, a new question has emerged regarding whether Mexico’s repayment of its water debt under the Rio Grande Compact shores up supplies enough to impact market activity. (For more on Mexico repaying its Rio Grande Compact water debt, see “Mexico Retires Rio Grande Water Debt in Full,” JOW March 2016). Will higher leasing activity and higher prices return with drier hydrologic conditions?

Written by Marta L. Weismann

You must be logged in to post a comment.