Demand for Lower Rio Grande water created a lease market in south Texas. Lease prices vary by use, with agricultural water users typically paying lower rates per acre-foot because they have lower consumptive use of water.

Municipal users have priority in the system, with a municipal reserve of 225,000 AF reestablished each month. Excess water is allocated to irrigators, who must have a balance available in a revolving account to take delivery of water. The long-term average allocation for Lower Rio Grande contracts is 2.5 AF/acre.

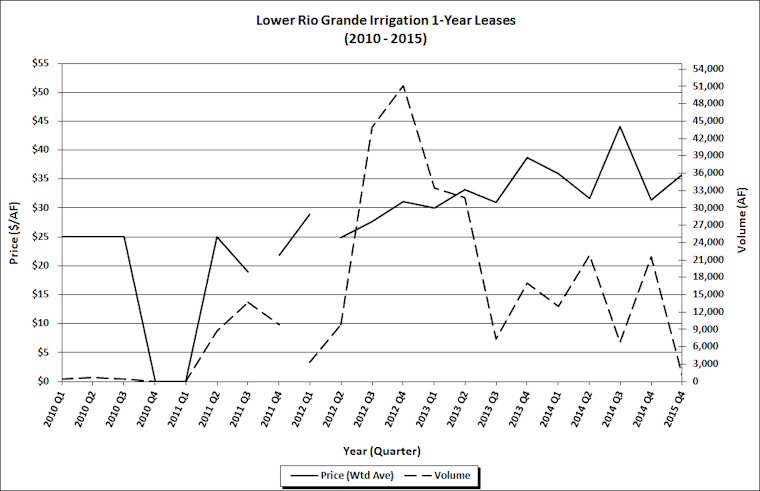

Between 2009 and early 2011, water supplies were abundant, so the watermaster was able to provide full allocations (4 AF/acre), and during flood operations at the Falcon and Amistad Dams, the Rio Grande Watermaster provided “free water” that does not count against contractors’ accounts. As a result, leasing activity for irrigation water was sparse during that time.

Heavy rain and flooding led to a similar situation last spring, depressing leasing activity for 2015. Leases for irrigation water totaled 987 AF during the 4th quarter—compared to 2,045.20 AF in the 3rd quarter, no leases in the 2nd quarter and 29,115.00 AF in the 1st quarter. In the fourth quarter 2014, irrigation leases totaled 21,557 AF (see chart).

Prices for irrigation water have increased. Prices ranged from $27/AF to $40/AF, with an average price of $35.78/AF. In the third quarter, all of the irrigation water leases were priced at $30/AF, which is commensurate with the 1st quarter average price of $30.91/AF. In the fourth quarter 2014, prices averaged $31.37/AF.

Because municipal users have priority in the system, the market for leases of municipal water is usually thin. Activity for industrial use and mining is also limited. In the 4th quarter, there were nine leases of municipal water totaling 629 AF with an average price of $64/AF. A construction company leased 1 AF for industrial use at a price of $100/AF, and there were two leases totaling 1,010 AF for mining use with an average price of $150.49/AF.

When dry conditions resumed after the 2009-2011 wet period, so did leasing activity. The market peaked in the fourth quarter 2012 with irrigation leases totaling 51,183 AF for just that quarter, and trading remained high—rivaling or exceeding the amount of activity seen during the drought of the late 1990’s.

If past behavior is the best indicator of future behavior, a similar pattern can be expected this time. However, a new question has emerged regarding whether Mexico’s recent repayment of its water debt under the Rio Grande Compact shores up supplies enough to impact market activity.

As drier hydrologic conditions return, expect activity and prices to return to a high level, especially if Mexico again amasses a water debt under the Rio Grande Compact. (For more on Mexico repaying its Rio Grande Compact water debt, see “Mexico Retires Rio Grande Water Debt in Full,” this issue).

Written by Marta L. Weismann

You must be logged in to post a comment.