Demand for Lower Rio Grande water created a lease market in south Texas. Lease prices vary by use, with agricultural water users typically paying lower rates per acre-foot because they have lower consumptive use of water.

Municipal users have priority in the system, with a municipal reserve of 225,000 AF reestablished each month. Excess water is allocated to irrigators, who must have a balance available in a revolving account to take delivery of water. The long-term average allocation for Lower Rio Grande contracts is 2.5 AF/acre.

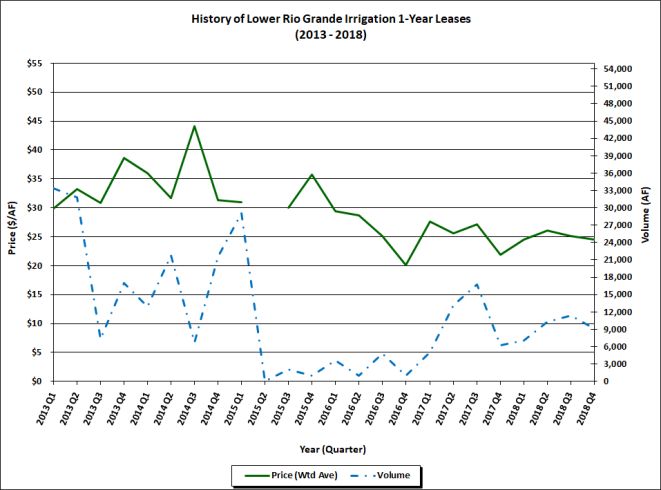

Between 2009 and early 2011, water supplies were abundant, and the watermaster could provide full allocations (4 AF/acre), and during flood operations at the Falcon and Amistad Dams, the Rio Grande Watermaster provided “free water” that does not count against contractors’ accounts. As a result, leasing activity for irrigation water was sparse during that time.

Record-breaking rainfall and flooding in the spring of 2015 led to a similar situation depressing leasing activity for 2015. The low level of activity continued in 2016, when the March-to-May rainfall totaled 200% to 300% of average for much of the valley. Only 10,359.84 AF of irrigation water changed hands over the year—less than 10% of the annual volume for 2012, the highest year on record. The end of 2018 was marked by frequently changing conditions. But there were more warmer-than-average periods than colder-than-average periods.

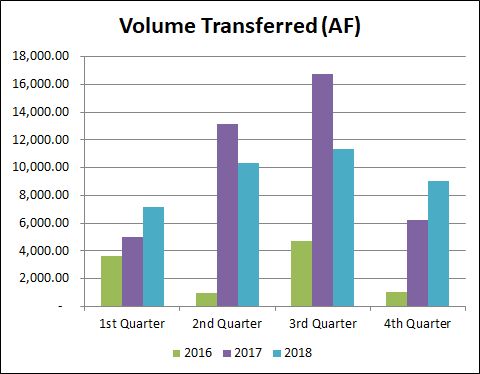

Activity increased in the fourth quarter of 2018, compared to the previous three years, but is below the historic average.

The fourth quarter of 2018 saw 12 transfers of irrigation water total 9,062 AF—compared to 6,202.44 AF in third quarter of 2017 and 11,373.33 AF in the third quarter of 2018. Over the last 10 years, fourth quarter volumes ranged from 0 (no transfers) to 51,183.12 AF, with an average of 12,362.22 AF.

Average prices continue to ease from earlier this year but are higher than recent fourth quarter prices. Prices for the fourth quarter of 2018 averaged $24.53/AF—compared to $25.08/AF in the third quarter, $26.04/AF in the second quarter, and $24.56/AF in the first quarter. In the fourth quarter of 2017, average prices were $21.87/AF.

Current prices are below the long-term average and the median fourth quarter prices. Over the last 10 years, fourth quarter prices ranged from $15.24/AF to $38.67/AF, with an average of $27.33/AF and a median of $30.57/AF.

Because municipal users have priority in the system, the market for leases of municipal water is typically thin. Transfers of municipal water were unusually high in the fourth quarter, with 9 transfers totaling 1,635 AF at prices ranging from $35/AF to $65/AF. The average price was $43.49/AF.

There were no transfers for industrial use or mining during the fourth quarter.

While the fall gave the region a reprieve from drought, the winter saw volatile conditions that oscillated between both hot and cold extremes. While a weak or moderate El Niño was projected for the spring, forecasters also expected frequently changing conditions leaning hotter and drier, and the summer brought record high temperatures. Expectations for market activity are tied to how to irrigators react to frequently changing conditions, as well as how the season plays out overall.

Written by Marta L. Weismann

You must be logged in to post a comment.